Optimizing Cash Management with Bond Ladder Strategy: Seizing the Opportunity in Competitive Yields

Presented By: Brian McKinney, CFP®

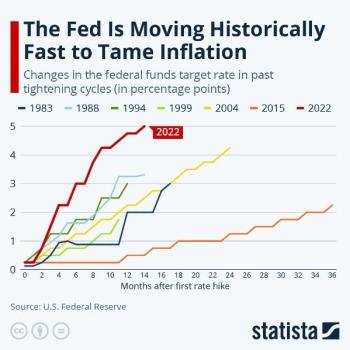

For the past decade, both savers and investors have struggled to find attractive yields in fixed-income and cash-equivalent securities due to historically low-interest rates. Remember the days of a mortgage rate of less than 3%? However, as the Federal Reserve adopts a cautious stance toward managing inflation by incrementally raising borrowing rates, traditional fixed-income and cash-equivalent securities have once again emerged as promising avenues for effective cash management and yield generation. As of early August, noteworthy developments include the Federal Reserve's sequence of ten consecutive federal funds rate increases since March 2022, a brief pause in June 2023, and a subsequent 0.25% hike in July 2023. In the midst of this ever-changing landscape, a bond laddering strategy gains significance as a prudent approach to managing cash reserves and cash equivalents, all the while harnessing the potential of prevailing competitive yields.

Understanding the Bond Ladder Strategy

At its core, the bond laddering strategy revolves around constructing a well-balanced portfolio of bonds with staggered maturities. The fundamental premise involves diversifying investments across various maturity dates, thereby mitigating the impact of fluctuations in interest rates, ensuring liquidity at regular intervals, and potentially reaping higher yields. This strategy departs from the conventional practice of concentrating funds in a single bond or maturity, instead advocating for the creation of a "ladder" comprised of bonds with different maturity dates. For example, the chart below shows 4 maturities and the current corresponding rates:

|

Maturity |

Yield* (%) |

|

3-month |

5.40* |

|

6-month |

5.49* |

|

12-month |

5.38* |

|

2-year |

4.92* |

*Click here for current figures: Bloomberg - Current Treasury Yields (as of 08/02/2023)

Creating an Effective Bond Ladder:

1. Aligning with the Yield Curve:

Consider the timeline of when you may need the funds and align the ladder's maturities accordingly. For example, if you require cash in two years, construct a ladder with bonds maturing at regular intervals over that period. It is also important to remember the current yield curve and how this may affect the return on each rung of your proposed ladder.

2. Select the Bond Types:

Bonds can vary based on factors such as rating, maturity, coupon, and tax implications. Consider your risk tolerance, tax situation, and investment goals to determine the appropriate bond types for your ladder. Examples include treasury bills, municipal bonds, corporate bonds, and government-backed securities.

3. Maturity Diversification:

Allocate your investment across different bond maturities within the chosen range. This approach helps to ensure a consistent cash flow as the bonds mature.

4. Reinvest Maturing Bonds:

As bonds mature, if you don’t need the funds to replenish your cash reserves or for a particular purpose, but still require safety and liquidity, reinvest the proceeds into new bonds at the longest end of the ladder to maintain the staggered structure. This reinvestment can be done to take advantage of potentially higher yields offered by longer-term bonds.

Criteria for Bond Selection:

1. Credit Quality:

Higher-rated bonds generally provide greater safety but may offer lower yields. Evaluate your risk tolerance and select bonds with ratings that align with your investment objectives.

2. Maturity:

Match bond maturities to your investment horizon. Shorter-term bonds offer greater liquidity, while longer-term bonds typically provide higher yields. While longer-term bonds typically offer higher yields, in times of monetary tightening it is not uncommon to see an inversion in the yield curve, as shown in the table above. So, when creating a ladder be mindful of the maturity/yield tradeoff. But using the yield example above, this is not always the case.

3. Coupon:

Bonds with elevated coupon rates generate more substantial income streams. Evaluating whether consistent income or potential capital appreciation is prioritized aids in tailoring the ladder to specific financial goals.

4. Tax Implications:

The investor's tax situation informs the decision between tax-exempt municipal bonds (“munis”) and taxable bonds. Acknowledging that treasury bill yields are exempt from state taxes and municipal bond yields are exempt from federal taxes, prudent selection hinges on aligning bond choices with prevailing tax considerations. Moreover, the tax implications of owning municipal bonds issued by one's own state or local government further compound this decision-making process. Consult with a tax advisor to determine the most suitable bond types.

Key Considerations Before Implementing a Bond Ladder

1. Comfort with Marketability:

Understand that bond ladders involve holding bonds until maturity. Ensure you are comfortable with potentially limited marketability if you choose longer-term maturities. That is, if you don’t hold your bonds to maturity, you may not receive your invested principal at the time you sell said bond(s).

2. Transaction Costs and Expenses:

It's essential to incorporate trading fees and commissions into the overall assessment of real returns associated with the bond ladder.

The Silver Lining for Savers

In the current landscape characterized by the Federal Reserve's policy moves, the bond laddering strategy emerges as a robust mechanism for skillful cash reserve management. By orchestrating a ladder of bonds with staggered maturities, investors can deftly optimize their cash flow dynamics, curtail market risk exposure, and potentially amplify their yield potential. As the door to alluring yields swings open courtesy of the Federal Reserve's strategic actions, integrating sophisticated cash management strategies into a holistic investment portfolio becomes not only prudent but imperative for both savers and investors alike.

*Click here for current figures: Bloomberg - Current Treasury Yields (as of 08/02But us/2023)

Williams Asset Management is located at 8850 Columbia 100 Parkway, Suite 204, Columbia, MD 21045. For additional information about the services of Williams Asset Management, please call (410) 740-0220.

Advisory services offered through Commonwealth Financial Network®, a Registered Investment Adviser.

Williams Asset Management and Commonwealth Financial Network® do not provide legal or tax advice.

This material has been provided for general informational purposes only and does not constitute either investment or tax advice. Although we go to great lengths to make sure our information is accurate and useful, we recommend you consult a financial advisor or tax preparer.