Understanding IRMAA Tax: Mitigating Medicare Premium Increases for Newly Retired Individuals

Written by Brian McKinney CFP®

Published in the Baltimore Business Journal on October 30, 2023

As individuals approach retirement and Medicare eligibility, it becomes essential to understand the potential impact of the Income-Related Monthly Adjustment Amount (IRMAA) tax on their Medicare premiums. IRMAA is an additional premium charged to individuals with higher incomes, and it can significantly affect retirement budgets. In this blog post, we will delve into what IRMAA tax is, how it affects newly retired individuals' Medicare premiums, and discuss two strategies to mitigate its impact.

What is IRMAA Tax?

IRMAA tax is a provision in the Medicare program that requires higher-income individuals to pay an additional amount on top of their standard Medicare Part B and Part D premiums. The purpose of IRMAA is to ensure that wealthier retirees contribute more towards the cost of their healthcare coverage.

How IRMAA Could Affect Newly Retired Individuals

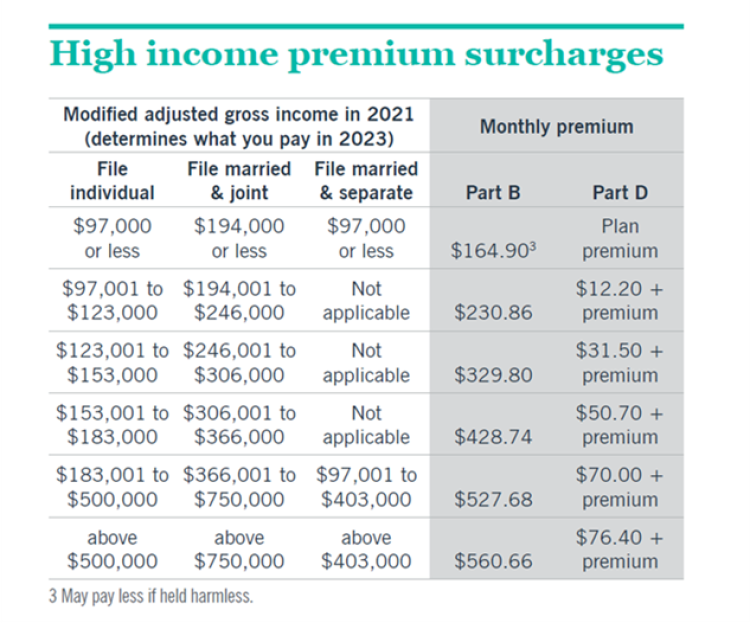

IRMAA tax impacts Medicare Part B and Part D premiums based on an individual's Modified Adjusted Gross Income (MAGI) from two years prior. MAGI includes Adjusted Gross Income (AGI) plus certain tax-exempt interest (TEI). The Social Security Administration (SSA) uses tax return information from two years prior to determine IRMAA brackets and subsequent premium amounts. This two-year lookback period can snag a lot of new retirees. For example, if you are working full-time in 2022 and had an adjusted gross income of $500,000, but in 2024 you retire in the beginning of the year at age 65 and have no wages, you will be subject to IRMAA tax in 2024 even though you are retired! Sound unfair? Well, the good news is there is a strategy available to request an exception to the IRMAA tax.

Mitigating IRMAA Tax: Two Strategies

1. Filing an Appeal with Form SSA-44: Once individuals receive notification that they are subject to IRMAA tax, they can file an appeal using Form SSA-44. This form allows individuals to explain certain life-changing events, such as retirement, reduced work hours, or loss of income, which may have caused a decline in their MAGI. The SSA reviews the appeal and adjusts the IRMAA tax if the circumstances warrant it.

2. Working with Financial and Tax Planners: Financial planners and tax planners can play a crucial role in helping individuals keep their AGI + TEI below certain IRMAA triggering levels. By strategically managing income sources, deductions, and tax-exempt investments, these professionals can help retirees structure their finances to reduce or eliminate IRMAA tax.

Below is a summary of the 2023 IRMAA income brackets and the corresponding monthly Part B and Part D premium amounts:

Source: Medicare.gov

What makes up my AGI + TEI?

Adjusted Gross Income (AGI) is an individual's total income from all sources, such as wages, investments, and business profits, minus specific deductions like student loan interest or contributions to retirement accounts. AGI serves as the starting point for calculating various tax obligations.

Tax-Exempt Interest (TEI) refers to interest income that is not subject to federal income tax. Examples include interest earned from municipal bonds. TEI is added back to AGI to determine MAGI, which is ultimately used to determine IRMAA tax.

Are Medicare Age or Retirement on your horizon?

If you are approaching retirement, it is prudent to review your current financial plan to assess whether you may be subject to IRMAA tax. By understanding the IRMAA tax implications and employing proactive or reactive strategies, such as working with financial and tax planners or filing appeals, you can mitigate the burden of increased Medicare premiums. By being proactive and planning, you can help ensure that your retirement budget remains stable and aligned with your financial goals.

Williams Asset Management and Commonwealth Financial Network® do not provide legal or tax advice. This material has been provided for general informational purposes only and does not constitute either investment or tax advice. Although we go to great lengths to make sure our information is accurate and useful, we recommend you consult a financial advisor or tax preparer.