Donating Your Business Interest to Charity Before You Exit

March 10, 2023

The prospect of retiring and selling a business can be a daunting task for business owners.

After dedicating their careers to building their company, the process of selling their interests can be complex and overwhelming, especially if the business has significantly increased in value. This article will explore why an LOI is valuable, the benefits and pitfalls of donating stock to a DAF, and how to make the most of this strategy.

Additionally, this event often represents the most significant wealth trigger event for business owners, so comprehensive wealth management and legacy planning discussions must occur simultaneously. Therefore, charitable planning is a crucial component of the entire process, as donating privately held business interests can help achieve tax savings, charitable giving, and legacy planning objectives.

For many business founders, the initial cost of starting their company may have been minimal, or even zero. However, when they sell their interest, they may trigger substantial capital gains taxes. One solution to minimize these taxes is to donate a portion of the ownership interest to charity. This approach provides the business owner with a charitable tax deduction based on the fair market value of the donated interest, while also reducing their exposure to capital gains taxes for the portion that is donated and sold by the charity instead of the business owner.

Donating privately owned company stock to a donor-advised fund (DAF) can be a smart strategy for business owners looking to maximize their tax deductions while supporting charitable causes they care about. This approach can be particularly advantageous for S or C corporation shareholders who have received a letter of intent (LOI) to buy their company. This article will explore why an LOI is valuable, the benefits and pitfalls of donating stock to a DAF, and how to make the most of this strategy.

Why a Letter of Intent is Valuable

An LOI is a document that outlines the basic terms of a proposed transaction, including the purchase price, payment terms, and other vital details. For a business owner planning to sell their company, receiving an LOI is an essential step in the process. It signals that the buyer is serious about the purchase and that negotiations can proceed to the next stage.

However, it’s important to note that an LOI is not a binding agreement. The final terms of the sale will be detailed in a purchase agreement, which is a legally binding contract and can possibly create a situation where it may not be possible to avoid capital gains tax even if gifting to a charity. While an LOI is not a final agreement, it can be an opportune time for the business owner to consider charitable giving as part of their financial planning.

More specifically, the reason an LOI creates an opportunity to optimize the business owner’s philanthropic goals is that the IRS will require the business owner to value the stock accurately. Since a valuation is necessary for any charitable gift over $5,000 that is not publicly traded, working with a qualified appraiser is necessary. The business owner can potentially use the LOI to assist in effectively determining the value of the company, which will be reported on IRS Form 8283 and attached to the donor’s IRS Form 1040. Something to remember: the valuation can be obtained no earlier than 60 days before the date of the donation and no later than the date of the donor’s tax return for the year the gift is due, with extensions.

Lastly, the LOI is important because, due to the likely illiquidity of privately held company stock, the appraiser would possibly discount the value of the company, which is the opposite of what is intended – to maximize the value and the charitable deduction.

Benefits of Donating Stock to a DAF

When a business owner donates privately owned company stock to a DAF, they can receive significant tax benefits. One of the primary benefits is that they can receive an income tax deduction for the total fair market value of the donated stock. This can be particularly advantageous for owners of S and C corporations, who likely have a large amount of unrealized capital gains in their company stock. But, more importantly, and the impetus for this article, the gain will be substantially more significant and realized after the sale.

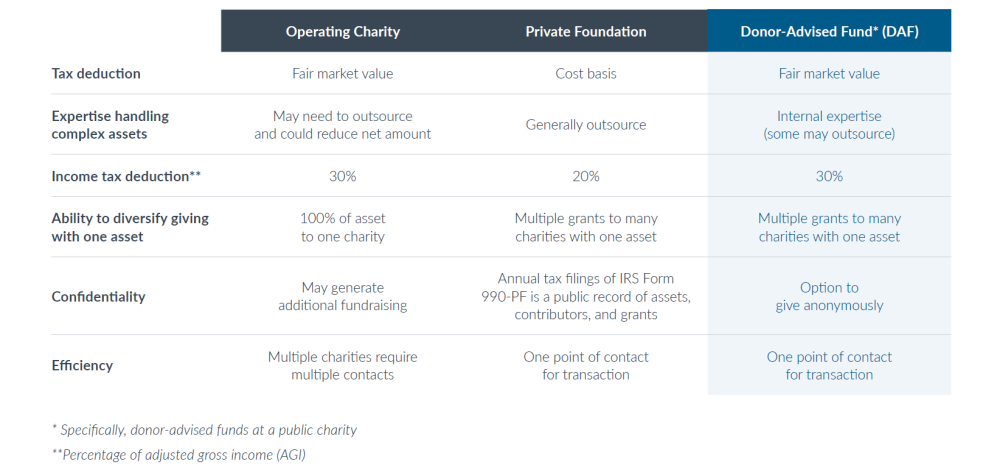

Sometimes the idea of using a private foundation comes up in conversation for this strategy. However, it is important to be aware that a private foundation is not ideal when gifting privately held stock since, with a foundation, you can only deduct the cost basis of the stock, not the appraised value.

Source: FidelityCharitable.org

More specifically, in addition to the income tax deduction, donating the privately owned company stock to a DAF before the sale can also help avoid the capital gains tax that would be incurred if the owner sells their company. This is because the DAF is a tax-exempt organization, which means it can sell the stock without incurring any tax liability.

Consider the Following Example:

Let’s suppose you are expecting the sale of a minority interest in a privately owned C corp business for $10 million1 and you would like to donate it to charity. The $10 million is composed of a $4 million initial investment and $6 million of realized gains.

| Option 1: Sell the Stock and Use After-Tax | Option 2: Contribute Private Company Stock Proceeds to FundGiving Directly to Charity |

| Total taxes paid (23.8%)2: $1,428,000 | $0 |

| Net charitable donation: $8,572,000 | $10M $1.4 million MORE donated to charity! |

| Net federal tax deduction: $8,572,000 | $9,200,0003 |

| Net federal tax savings (37%): $3,171,640 | $3,404,000 Additional TAX SAVINGS of $232,360! |

Pitfalls to Consider

While donating stock to a DAF can be a smart financial strategy, there are a few pitfalls to consider, ensuring that the owner maximizes their tax deductions and avoids any unexpected tax liabilities. One of the primary pitfalls is the need to value the donated stock accurately. The IRS requires that donated stock be valued at its fair market value on the date of the donation, which can be challenging for privately owned companies to determine. The LOI can potentially be used to assist in the appraisal process to accomplish this requirement. As mentioned earlier, a business owner must work with a qualified appraiser to ensure that the LOI will suffice for valuation purposes. One final word of caution on this front: if the sale has proceeded to the point where the shareholder is considered to be holding the right to receive the proceeds from the sale, the shareholder cannot avoid the capital gains tax by donating the shares. This is referred to as “anticipatory assignment” of income.

This is something the business owner needs to be aware of; from the charity’s perspective, the risk of holding a privately held stock should be considered. The recipient charity will review the business’ governing documents (i.e., shareholder agreement) to make sure there are no transfer restrictions and/or requirements to transfer the stock. Also, when the deal closes, as a selling shareholder, the charity may need to make certain representations or warranties that may include financial risk. These potential risks may make it necessary for the charity to seek indemnification from the donor. Lastly, while charities can own S corporation stock, ownership of S corporation stock has some negative consequences. Specifically, a charity’s entire share of income or loss from an S corporation is unrelated business income (UBI) that is taxable to the charity even if the income would not be taxable if the charity had earned it directly (i.e., if the income were from rents or royalties, etc.). Also, when a charity sells S corporation stock, the gain or loss on the sale is UBI subject to tax. Most large DAFs have experience with S corporation stock donations and will be able to assess the risks so the business owner doesn’t need to be too involved or concerned about these factors.

Finally, it’s important to note that there are limits on the amount of charitable contributions that can be deducted in any given year. For individual taxpayers, the limit is typically 60% of adjusted gross income (AGI) and 30% of AGI for appreciated assets. Important to note: you can carry forward these deductions for five years. These limits can vary depending on the specific circumstances, so it’s essential to consult with a tax professional to ensure that the donor is making the most of their tax deductions.

In conclusion, donating privately owned company stock to a DAF can be a smart strategy for business owners who are selling their businesses and looking to support charitable causes while maximizing their tax deductions and avoiding taxes on the gain from the business. By understanding the benefits and pitfalls of this approach and engaging the right professionals, business owners can make the most of this strategy and achieve their financial and philanthropic goals.

If you have a relationship with an advisor, such as a trusted Certified Public Accountant, attorney, or CERTIFIED FINANCIAL PLANNER® professional, you should consider working together as a team through this process. With a team of advisors and a holistic approach, you will be able to optimize your philanthropic goals and the tax consequences of your gift.

1Amount of the proposed donation is the fair market value of the appreciated securities held more than one year. This example assumes a qualified independent appraisal to determine the fair value of the security has been completed.

2This assumes all realized gains are subject to the maximum federal long-term capital gains tax rate of 20% and the healthcare surtax of 3.8%. State and local taxes, if any, are not considered in this illustration.

3An 8% valuation discount is applied for lack of marketability and minority interest. The discount applied can vary greatly and is based on the relevant facts. See instructions to IRS Form 8383 for further information.