How to Invest at Stock Market All-Time Highs: A Practical Guide to Confident Investing

January 14, 2025

Imagine this: the S&P 500 is on fire, breaking records and hitting all-time highs, and your portfolio is basking in the glow of success. But amidst this market euphoria, there’s a nagging thought: “Should I invest now, or am I just buying at the top?” It’s a common dilemma, one that leaves investors teetering between fear and greed.

The good news? All-time highs don’t signal doom—they’re milestones on the path of long-term growth. Historical data shows that investing at market highs often pays off over time. Even when you feel as though the market cannot go up anymore, maintaining discipline and sticking to time-tested strategies can help you achieve your financial goals. In this article, we’ll explore how to navigate all-time highs with confidence, focusing on diversification, alternative investments, and practical strategies tailored to your circumstances. And by the time you are reading this, hopefully we are still at all-time highs, but it can change at a moment’s notice!

Why All-Time Highs Are a Good Thing

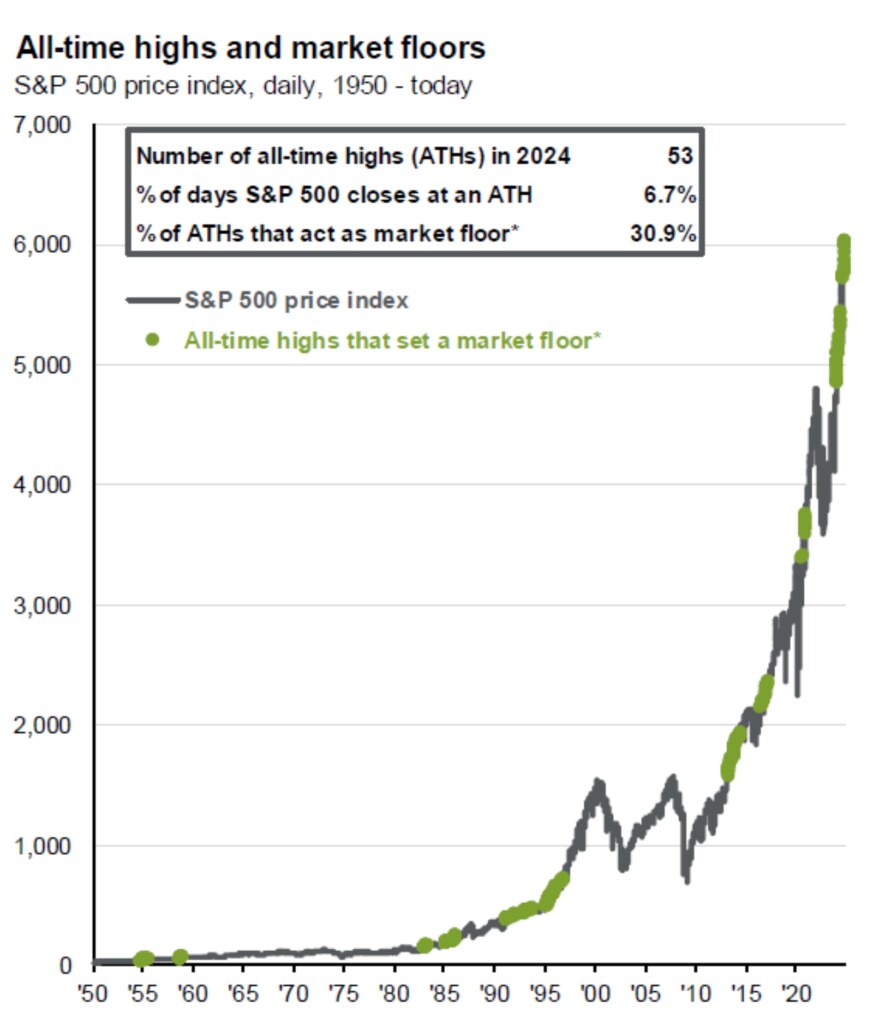

It’s natural to feel hesitant about investing, or maybe even staying invested, when markets are at record highs. The fear of an imminent crash can be paralyzing. In a way, it is closely tied to the idea of Murphy’s Law, which states that anything that can go wrong, will go wrong. With that said, it is not uncommon for us as emotional human beings (especially when it comes to our hard-earned money), to think that the moment we go to invest, the market will crash. But the truth is, all-time highs are a normal part of a healthy market. In fact, since 1950, the S&P 500 has spent about 6.7% of trading days at record levels.

Market floor is defined as an all-time high from which the market never fell more than 5%.

Source: FactSet, Standard & Poor’s, J.P. Morgan Asset Management

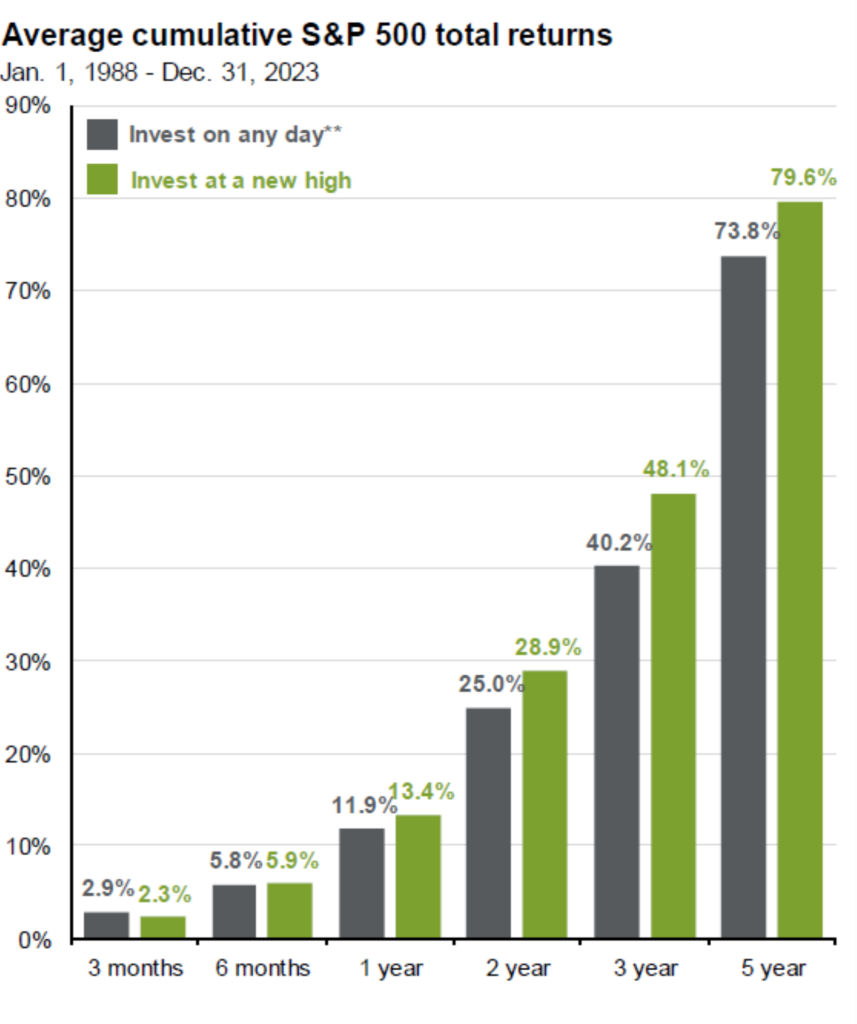

If you avoided investing during these highs, you’d have missed out on significant growth. History tells us that markets tend to climb higher over time, even after hitting peaks. For instance, the average one-year return after investing at an all-time high is 13.4%, and over five years, it climbs to an astonishing 79.6%. These numbers are higher than if you were to invest on any other day, impressively enough.

Source: FactSet, Standard & Poor’s, J.P. Morgan Asset Management

“Invest on any day” represents average of forward returns for the entire time period whereas “Invest at a new high” represents average of rolling forward returns calculated from each new S&P 500 high for the subsequent 3-months, 6-months, 1-year, 2-year and 3-year intervals, with data starting 1/1/1988 through 12/31/2023.

All-time highs often act as new market floors rather than ceilings, as shown in the charts above. These statistics highlight a crucial point: missing out on market highs can mean missing out on significant growth. Markets are designed to climb over the long term, making time in the market far more important than timing the market.

Understanding the Market Context

To invest effectively during all-time highs, you need to understand the broader market environment. While record highs often indicate market strength, they can also reflect heightened risks, such as overvaluation or concentrated performance in specific sectors.

Valuations and Expectations

Currently, some analysts warn that the market may be overvalued, with price-to-earnings (P/E) ratios exceeding historical norms. According to the Wall Street Journal, much of this overvaluation stems from a small group of dominant tech stocks— dubbed the “Magnificent Seven”—which have accounted for a disproportionate share of market gains in 2024. (Source: https://www.wsj.com/finance/stocks/stock-market-overvalued-forecasts-2025-e073e1d4)

While elevated P/E ratios might suggest limited short-term upside, they don’t necessarily predict a crash. Instead, they reflect investor optimism about future growth. It’s essential to focus on the economic fundamentals underpinning these valuations.

Corporate Earnings and Economic Resilience

Despite valuation concerns, strong corporate earnings and economic recovery have supported market highs. Companies across sectors have reported better-than-expected profits, driven by post-pandemic demand and innovations in technology and renewable energy. However, rising interest rates and geopolitical uncertainties introduce potential headwinds, making it critical for investors to adopt a balanced and diversified approach.

The Concentration Risk

One notable trend is the concentration of gains in a few high-performing stocks. While these tech giants have delivered extraordinary returns, they also pose a risk: if these companies falter, the broader market could lose momentum. This highlights the importance of diversification, which we’ll discuss in more detail below.

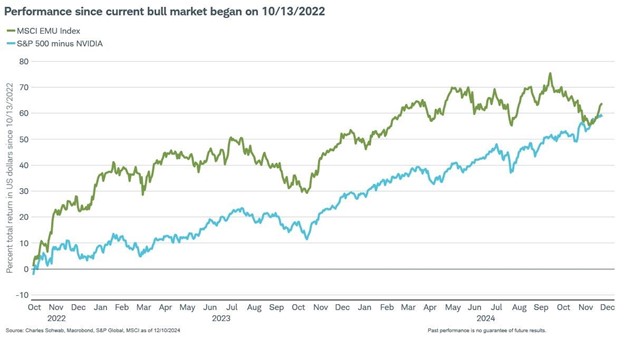

But before we get to diversification, let’s put a stamp on this concentration risk we are talking about here. Coming from the commentary of Jeffrey Kleintop, the Chief Global Investment Strategist for Charles Schwab, if Nvidia (Ticker: NVDA), one of the stocks considered in the “Magnificent Seven,” was not part of the S&P 500, Europe’s stock market would be outperforming the S&P 500 since the current bull market began.

The Case for Diversification

Diversification is one of the most powerful tools investors have at their disposal to manage risk and enhance return potential. By spreading your investments across asset classes, sectors, and geographies, you can create a portfolio that is designed to ideally perform well in varying market conditions.

Asset Class Diversification

At all-time market highs, equities often steal the spotlight. However, relying solely on stocks can leave your portfolio vulnerable to volatility. Diversifying into other asset classes can help mitigate this risk:

- Equities:

U.S. equities, particularly in technology, have driven recent market highs. However, international equities provide exposure to economies at different stages of growth. Emerging markets, for instance, offer high-growth potential, while developed markets like Europe and Japan can provide stability. - Bonds:

Bonds play a crucial role in reducing portfolio volatility. Even though rising interest rates may dampen bond prices, they can provide a counterbalance to equity market risk. Diversifying across sectors and strategies can offer a mix of safety and income. - Alternatives:

Alternative investments such as private equity, hedge funds, and real estate can enhance portfolio diversification and can provide unique growth opportunities. Private equity allows investors to participate in the long-term potential of privately held companies, often with higher returns than public markets. Hedge funds utilize a variety of strategies, including long-short equity and global macro, that seek to generate returns and manage risk in diverse market conditions. Real estate offers tangible asset exposure, potential for steady income through rental yields, and a hedge against inflation, all while often moving independently of stock and bond markets. By incorporating alternatives, investors can ideally build a more resilient and balanced portfolio.

Sector Diversification

Within equities, diversifying across sectors reduces the risk of overexposure to a single industry. Recent market highs have been driven largely by technology stocks, but other sectors may be more reasonably priced.

Geographic Diversification

Geographic diversification broadens your portfolio’s exposure to global growth opportunities. While U.S. markets have led in recent years, international and emerging markets often outperform during other cycles. Adding these regions to your portfolio ensures you’re not overly reliant on a single economy.

The Power of Alternative Investments

Alternative investments have become increasingly important for diversifying portfolios and enhancing return potential. These include private equity, venture capital, real estate, infrastructure, and direct lending, just to name a few.

Why Consider Alternatives?

Alternatives offer several benefits:

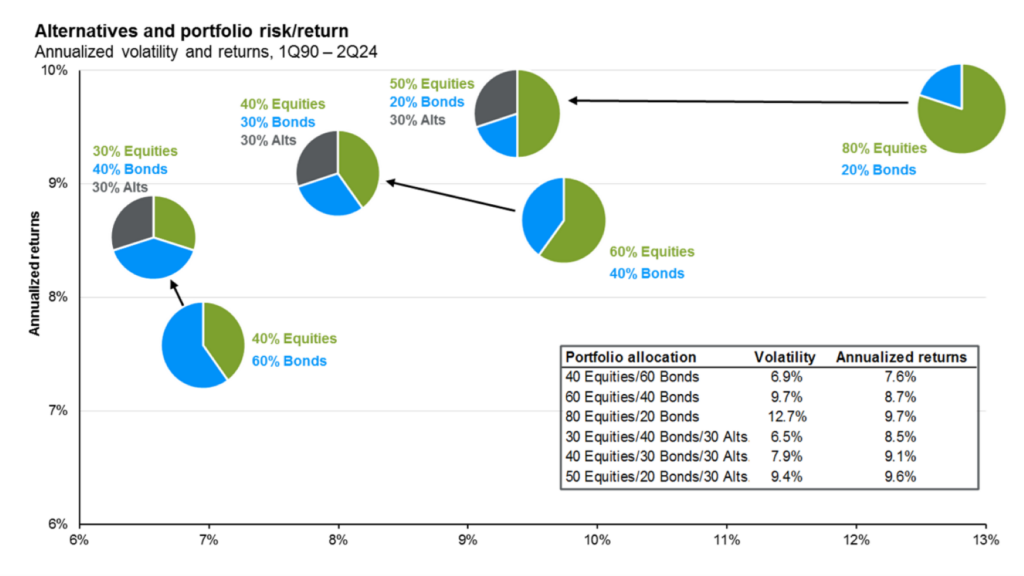

- Higher Returns: Going back to 1990, a portfolio with a portion allocated to alternative investments has consistently outperformed traditional stock/bond portfolios.

Source: Bloomberg, Burgiss, HFRI, NCREIF, Standard & Poor’s, FactSet, J.P. Morgan Asset Management. Alts include hedge funds, real estate, and private equity, with each receiving an equal weight. Portfolios are rebalanced at the start of the year. Equities are represented by the S&P 500 Total Return Index. Bonds are represented by the Bloomberg U.S. Aggregate Total Return Index. Volatility calculated as the annualized standard deviation of quarterly returns. All indices are unmanaged, and investors cannot actually invest directly into an index. Unlike investments, indices do not incur management fees, charges, or expenses. Past performance does not guarantee future results.

Data are based on availability as of November 30, 2024.

- Low Correlation with Stocks and Bonds: This reduces overall portfolio volatility.

- Income Generation: Real estate, infrastructure, and direct lending can provide steady income streams.

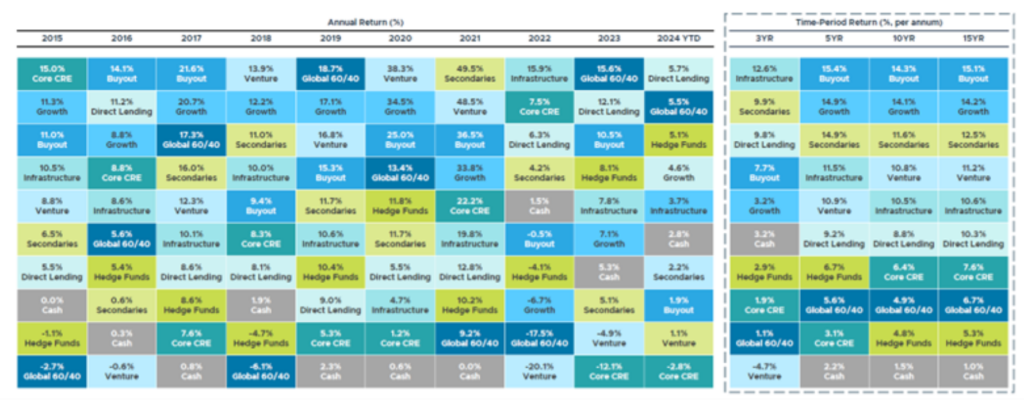

For instance, looking at Chart 1 below, core commercial real estate posted a 7.5% return in 2022, while infrastructure delivered 15.9%. These figures demonstrate their value in a well-diversified portfolio, which is illuminated even more when global markets in both stocks and bonds were negative that same year.

Chart 1:

Source: Bloomberg Index Services Limited, Cliffwater Direct Lending Index, FTSE Russell, Hedge Fund Research (HFR), MSCI, NCREIF, Preqin, iCapital Investment Strategy, with data based on availability as of Oct. 31, 2024. Note: Data as of June 2024 and is subject to change based on potential updates to source(s) database. Buyout proxied by Preqin Private Equity Buyout Index. Growth proxied by Preqin Growth Equity Index. Venture proxied by Preqin Venture Capital Index. Secondaries proxied by Preqin Secondaries Index. Infrastructure proxied by Preqin Infrastructure Index. Direct Lending proxied by Cliffwater Direct Lending Index. Real Estate proxied by NCREIF Open End Diversified Core Equity (NFI-ODCE) Index. Hedge Funds proxied by Hedge Fund Research HFRI Fund Weighted Composite Index. Global 60/40 proxied by 60% MSCI ACWI Total Return Index and 40% Bloomberg Global Aggregate Index. Cash proxied by the FTSE 3 Month US T Bill Index, which is intended to track the daily performance of 3-month US Treasury bill, a measure we consider a proxy for cash returns. It is important to note that the returns listed are based on indices that are meant to estimate the asset class performance, hypothetically creating a return if one had access to all active funds. Not all the above indices are practically investable and are subject to change as datasets are continually updated. All returns are calculated in U.S. dollars. For illustrative purposes only. Past performance is not indicative of future results. Future results are not guaranteed.

Challenges of Alternatives

- Illiquidity: Many alternatives require long-term commitments.

- Complexity: Evaluating alternative investments demands expertise.

Despite these challenges, alternatives are worth exploring, particularly for investors seeking to mitigate risk while maximizing returns.

If you’re considering alternatives, consult with a financial advisor to determine which options align with your goals and risk tolerance. Many alternative investments, such as private equity and infrastructure funds, have certain minimum investment thresholds, but options like REITs (real estate investment trusts) and interval funds within private credit provide more accessible entry points.

How to Invest at All-Time Highs

If you’re ready to invest, choosing the right approach is key. Here are two common strategies:

- Dollar-Cost Averaging (DCA)

DCA involves spreading your investments over time. This method reduces the risk of committing a large sum just before a market correction. By investing consistently—whether markets are up or down—you potentially reduce emotional decision-making.

- Lump-Sum Investing

As we have written about before, the other option is to consider lump-sum investing. Lump sum investing simply means investing a large amount of money all at once. If you have a windfall—such as proceeds from a home sale or inheritance—investing it upfront might yield better long-term results.

Rebalancing and Managing Emotions During Market Highs

For investors who are already in the market during all-time highs, the challenge often lies in managing both their portfolio and their emotions. On one hand, you might be enjoying the thrill of seeing your investments reach new peaks; on the other, you may be questioning whether it’s time to take some of the profits or if you’re overexposed to certain assets.

This is where rebalancing becomes essential. When markets perform well, portfolios tend to drift away from their target allocations. For example, if your original allocation was 60% stocks and 40% bonds, a strong rally in equities could push that ratio to 70/30, increasing the overall risk of your portfolio. Rebalancing involves selling a portion of the outperforming assets (like stocks) and reallocating those funds to underperforming or more stable ones, such as bonds or alternatives. This strategy helps lock in gains while keeping your portfolio aligned with your goals and risk tolerance.

At the same time, it’s crucial to manage emotions like fear and FOMO (fear of missing out). Fear can prompt premature selling, while FOMO may tempt you to chase returns by doubling down on already inflated sectors. Both reactions can disrupt a well-thought-out plan. The best approach is to stay disciplined. Trust your long-term strategy, resist making impulsive decisions, and remember that markets move in cycles.

The key takeaway for investors during all-time highs is this: rebalancing and emotional discipline work hand-in-hand. By systematically adjusting your portfolio and maintaining a rational mindset, you can navigate market highs confidently while staying focused on your long-term financial goals.

Stay the Course

Investing at all-time highs can feel intimidating, but data shows that it’s often the right move. Markets climb over time, and staying invested ensures you’re positioned to benefit from that growth.

To navigate market highs effectively:

- Diversify across asset classes, sectors, and geographies.

- Consider incorporating alternatives for stability and enhanced return potential.

- Rebalance your portfolio when necessary to manage risk.

- Stay disciplined and avoid letting fear or FOMO dictate your actions.

Remember, all-time highs aren’t the end of the journey—they’re milestones along the path to long-term wealth. Whether you’re investing a lump sum or using dollar-cost averaging, you may find that the best strategy is to stay invested and let time work its magic. As the saying goes, “The best time to invest was yesterday. The second-best time is today.”

Brian McKinney, CFP®, is a Financial Advisor with Williams Asset Management. Williams Asset Management is located at 8850 Columbia 100 Parkway, Suite 204, Columbia, MD 21045. He offers advisory services as an Investment Adviser Representative of Commonwealth Financial Network®, a Registered Investment Adviser. Fixed insurance products and services offered by Williams Asset Management. Williams Asset Management does not offer legal or tax advice. You should consult a legal or tax professional regarding your individual situation. For additional information about the services of Williams Asset Management, please call (410) 740-0220 or email at Info@WilliamsAsset.com. © Williams Asset Management. For more information about Williams Asset Management, please visit www.WilliamsAssetManagement.com.

Diversification and dollar-cost averaging do not assure a profit or protect against loss in declining markets. No investment strategy can guarantee that any objective or goal will be achieved.