Why Most Americans Believe They Are Happy Underspending in Retirement

June 2, 2021

What are your retirement goals? That’s a tough question that can be answered in any number of ways. You could begin by explaining how much you want to save before you retire, what you plan to do in retirement, or even how long you hope to live.

But what we’re actually getting at here is: what are your retirement goals for your money?

Is your primary goal to avoid running out of money? To improve your lifestyle? Leave a sizeable legacy to your children or grandchildren? Or maybe it is “carpe diem” and you want to spend every last cent.

In our professional experience, there is immense diversity in how our clients want to spend their time in retirement, but an undeniable common denominator amongst how they want to spend their money. Interestingly enough, this recent Spending in Retirement Survey conducted by the Employee Benefit Research Institute (EBRI) has gathered statistical evidence that supports our own personal experiences with our clients.

So, what do many Americans (including our own clients) intend to do with their retirement savings? Well, exactly that, save it!

Source: Bloomberg April 2021

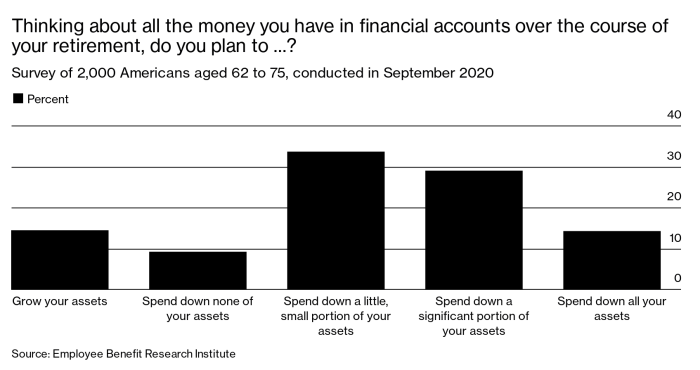

When the 2,000 Americans surveyed ages 62 to 75 in September of 2020 (97% of whom were already retired) were asked how they plan to spend their money over the course of their retirement, the highest-ranking answer was to “spend down a little, small portion of [their] assets.” When combined with the second-highest ranking answer, “spend down a significant portion of your assets,” this indicates that 43% of respondents reported wanting to leave at least some money in the bank. Only 14.1% responded that they intended to spend it all.

(Figure 1)

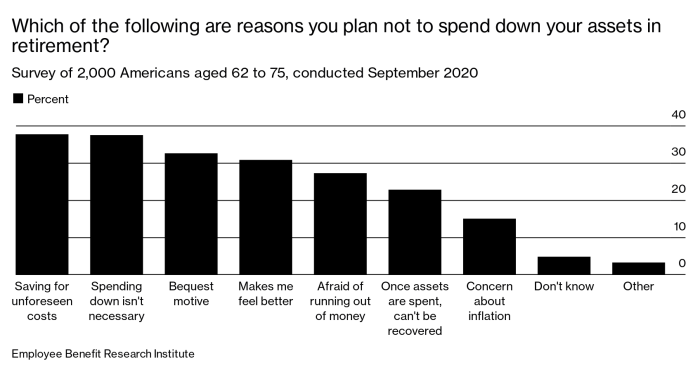

But what are their motivations? Needless frugality? Fear of running out of money? Leaving a sizeable legacy? When the group who said they don’t plan to spend down their assets in retirement was asked why, this is what the EBRI uncovered:

Source: Bloomberg April 2021

Quite frankly, many of the answers on this chart don’t surprise us, including saving for unforeseen costs, afraid of running out of money, and once assets are spent, can’t be recovered.

Why? They all further validate what researchers have proven and financial planners have known for decades: for many, the fear of outliving assets is more acutely terrifying than death! The idea of being dependent on someone else is not only a blow to one’s ego, but the admittance of failure—failure to prepare, failure to succeed, and more! And for those without family, where will they turn?

So, too, then does the answer “makes me feel better” also make sense, simply viewed through the other end of the lens. If spending makes people nervous, anxious, or worried about running out of money, then the logical inverse is that keeping money in the bank makes them feel secure, at peace, and not at risk of running out of money.

This mindset is common and deeply ingrained in many retirees. One participant of the survey even went as far as to say drawing down on assets felt the same as taking a loss; and there is no shortage of research stressing just how adverse individuals are to the sensation of losing money. In fact, an entire body of study known as Behavioral Finance exists to explore the neurobiological responses investors have to gains and losses and how it affects their decision-making. Poor decisions are often made when the fear of loss is greatest.

Putting the Pieces Together for More Life

From our perspective, no matter which end of the telescope you are looking in from here, fear is steering the ship to some degree. Not to say that rational fear isn’t a nice built-in safety net. In fact, it is a great motivator to not overspend. However, there are other safeguards that retirees can put into place to feel less worrisome about living off the assets they have accumulated to, well—live!

Some of these safeguards include long-term care insurance, funding tax-friendly savings vehicles to cover medical expenses (such as Health Savings Accounts), effective tax-planning strategies to support the longevity of your wealth, and an optimal social security benefits strategy.

One of the main reasons we find retirees feel uneasy about spending in retirement is because they view retirement, their investments, tax plans, social security, healthcare, and other financial responsibilities in silos without realizing a change in one will affect change in the entire system.

Change in one area of your financial life almost always inevitably affects change in another—sometimes for the worse, others for the better. The key is to know which moves will be the most beneficial overall.

The ultimate safeguard, then, is still the comprehensive financial plan. When working with a comprehensive model that addresses each area as part of a bigger system, the financial impact of any one decision is addressed and considered before moving forward. Retirement, investment management, tax planning, and reaching other major financial milestones are all aligned to give the retiree a clearer picture of what he or she can safely spend according to his or her own retirement goals.

One of the best parts, perhaps, of having a comprehensive financial plan in place is the elimination of some of the fear that could keep you from truly relishing the people and activities in life that bring you joy. This could be helping to pay for your grandchild’s education or traveling far and wide with your spouse. Many of our retiree clients even enjoy gifting some of their money each year to see their heirs benefit from their monetary gifts first-hand. The possibilities are truly endless (and the peace, invaluable) when you aren’t constantly wondering if you and your assets will be safe.

If you are ready to start building a truly comprehensive financial plan, or are in need of a trusted financial ally to help you make other important financial decisions, feel free to contact the advisors at William Asset Management to schedule a call today.